An opinion by

Dr. PETER W. DE LANGEN

Ports & Logistics Advisory

Copenhagen Business School

Peter@pl-advisory.com

KEY TAKEAWAYS

- Investments in the sustainability and energy transition have become an important investment category for Port Development Companies (PDCs).

- Some PDCs are investing specifically to attract zero-carbon industrial activities, such as offshore wind manufacturing and assembly, hydrogen production, and circular activities, to their port areas.

- Some PDCs have already successfully developed a circular ecosystem of companies, involved in waste collection, sorting, and recycling or upcycling. Many PDCs are still exploring the circular potential.

- Circular activities do not start out of nothing, in ‘splendid isolation’. On the contrary, circular activities are attracted by the strength of a port complex, especially in terms of feedstock and markets.

- The PDC can create value for circular businesses in the port, by providing new services such as pipelines for CO2/or hydrogen transport, power cables, and energy management systems.

- The circular transition goes hand in hand with less global flows, certainly of raw materials. Port business ecosystems are therefore changing, and in that change, they need more land, not necessarily more quay walls.

- When it comes to developing circular activities, an emergent development approach is often useful. In this approach, a PDC caters to the specific demand for land for circular activities, but makes it bigger to create land availability for currently unknown circular/zero-carbon activities.

- Initiatives to attract circular activities often gradually move away from the periphery and become more central to port development, up to the point where PDCs give them a prominent place in their long-term development visions and commercial initiatives.

In line with their “Memorandum for the European Elections”, the European Sea Ports Organisation (ESPO) recently published the “Port Investment Study 2024”, as an update of the ESPO 2018 study. This study shows that the changing and wider role of ports, comes with new and wider responsibilities and investment needs. Dr. Peter de Langen assisted ESPO with the survey, analyzed the responses, and co-authored the final report.

Circular Flanders asked Dr. Peter de Langen to also reflect on the investments of European ports from a circular economy perspective. First, he shares some insights into projects to attract zero-carbon industries, including circular activities. Next, Peter discusses the impact of the circular transition on the business models of port developers. Based on some cases where port developers are attracting circular activities, Peter concludes with some reflections that can help promote the circular transition.

Europe’s PDCs have €80 billion investment needs for the next 10 years

In April 2024, the European Sea Ports Organisation (ESPO) published the results of a study on the investment pipeline and investment challenges of European ports. The study is largely based on a survey of European Port Development Companies (PDCs).

The report concludes that PDCs in the EU and Norway have an investment pipeline of about €80 billion over the next 10 years. Investment projects are increasingly focused on improving the environmental performance of ports, and the value chains in which they are embedded. These do not include investments by commercial third parties such as terminal operators, logistics service providers, clean fuel producers, and energy companies. These companies’ investments are likely to be much larger than those of the PDCs.

PDC investment projects to attract zero-carbon industries

The ESPO survey results cover more than 100 EU ports. As the PDCs of most of the largest European ports participated (Rotterdam, Antwerp-Bruges, Hamburg, Marseilles, Haropa and Amsterdam amongst others), the responding ports cover more than 70% of the total cargo throughput in the EU. The PDCs submitted a total of 467 investment projects, ranging from investments in hinterland infrastructure, ICT systems to onshore power supply, and others.

One investment category covers investment projects aimed at attracting zero-carbon industries, including circular activities. This category was included to reflect the potentially important role of ports in attracting investment in clean, zero-carbon industries. Such investments are crucial for Europe’s transition to clean energy and ultimately to a net-zero economy. However, PDCs often need to invest in developing land to accommodate these activities, such as the production of hydrogen with green electricity, and the manufacturing and assembly of offshore wind components. Ports are often the best locations for such investments. An important category of new investments in zero-carbon industries can be called circular activities. These activities involve reusing or recycling end-of-life materials.

Based on the survey responses, we can conclude that about half of the PDCs plan to make investments specifically to attract new zero-carbon industries. This is also plausible, while many ports are developing land for industrial port-related activities, others are not, often simply because of the lack of land availability. Ports that are surrounded by urban activity often (have to) use the space exclusively for handling cargo vessels, cruise ships, and ferries.

The PDCs plan to make different types of investments, specifically to attract new zero-carbon industries. The most common type of investment is the expansion of port basins, quays, and terminal sites. This may be necessary, for instance, to attract the offshore wind industry to the port. In other cases, the PDC invests in services, such as hydrogen and electricity pipelines, which can be critical to attract zero-carbon industries. An example, electrolyzers which use electricity to split water into hydrogen and oxygen. Attracting these investments may require the PDC to (jointly) invest in the electricity grid and a hydrogen pipeline network.

Table 1. Investment projects aimed at attracting zero-carbon industries.

| Type of investment | Number of projects to attract new zero-carbon industries | Share of total projects to attract new zero-carbon industries |

| Expansion of port basins, quays, and terminal sites, including pavement of terminal sites | 26 | 32% |

| Infrastructure and services related to the energy transition of the economy | 21 | 26% |

| Sites for port-related logistics and manufacturing activities in the (proximity of the) port area | 8 | 10% |

Source: ESPO (2024) Port Investment Survey

A relatively limited number of PDCs (8) have planned investments to develop new sites for logistics and industrial activities, as a way to attract zero-carbon industries. However, this represents the vast majority of the total investment projects in port-related logistics and manufacturing sites (11). When ports invest in specific industrial and logistics sites, they often focus on attracting zero-carbon industries. This demonstrates the (perceived) growth potential of zero-carbon industries in ports. It also shows that many PDCs do not have investment plans for land expansion, probably because their expansion options are rather limited, both for spatial reasons the port is surrounded by urban functions- and for institutional reasons -difficulties in expanding the area for which the PDC is responsible.

A final relevant insight that can be drawn from the survey results is the share of the total planned investment projects that contribute to attracting zero-carbon industries. For some ports, such as the Port of Haugesund (Norway), Odense, Roenne, and Vordingborg (Denmark), and Groningen Seaports (the Netherlands) almost all projects serve to attract zero-carbon industries. The key zero-carbon industry for these ports is the offshore wind industry: almost all PDC investments aim to develop the port as a manufacturing, assembly, and supply hub for this segment. The potential of a port to become an offshore wind energy industry hub, is -to a large extent- determined by its location. Moreover, the location logic for offshore wind industry (i.e. the proximity to offshore wind parks) is totally different from the location logic for cargo flows – the traditional raison d’etre of ports, in which the ability to serve the hinterland is central. As a result, peripheral ports in freight corridors, such as Den Helder (the Netherlands) and Esbjerg (Denmark), may develop into important offshore wind industry ports.

Overall, these findings show that PDCs are investing to facilitate the transition towards zero-carbon value chains, and often also aim to attract zero-carbon industries to their port business ecosystems. The survey does not provide much detailed insight into the potential and challenges of ports as hubs for circular activities, as this was beyond the scope of the survey. I’ll discuss this challenge in more detail below.

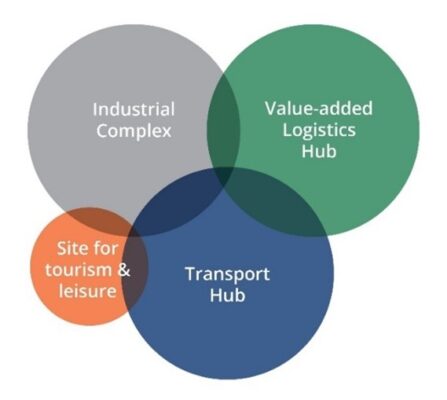

The Port Business Ecosystem

Historically, ports have enabled trade. The port infrastructure has become increasingly specialized. Economies of scale have led to an increasing concentration of port activities in a relatively limited number of large ports. In the early days of port development, quays were public infrastructure that could be used by all ships. The increasing size and specialization of ships, quays, and (un)loading equipment led to the emergence of Port Business Ecosystems (PBEs) which include the handling, storage, and processing of goods. Increasingly, port business ecosystems also include a leisure component, which may include cruise facilities, marinas, hotels, restaurants, and commercial real estate.

Circular activities in ports: various promising segments

A circular supply chain does not end with waste, but with the reuse of materials at the end of their lifecycle. The circular transition has important implications for supply chains, ranging from the way products are designed to the business models of companies (e.g. often a shift from selling products -cars- to providing services -mobility). The transition towards circularity also has important implications for ports, both through its impact on cargo volumes and because it provides opportunities to attract circular activities to port business ecosystems. In 2022, 11.5% of the material used in the EU was recycled, a small increase compared to 2010 . This shows that linear supply chains, ending with waste, still dominate. The EU has set a target of 20% for 2030. This target is unlikely to be reached, but there is certainly a huge transition to circularity ahead of us.

Circular activities in PBEs include dedicated terminals for recyclables such as scrap and paper pulp, sorting and dismantling of end-of-life (EOL) products, and processing of the resulting recovered materials , for instance, to produce biofuels or building materials.

Various types of benefits of being located in a port (business ecosystem) can explain why circular activities would be located in ports. All these benefits are ultimately forms of synergies, that arise in ports precisely because of the presence of several – often hundreds of – companies. First, companies can benefit from logistics infrastructure and services: companies have relatively cheap inbound and outbound logistics flows. Second, companies can benefit from input-output synergies when selling products (like scrap) to or buying resources (like cooking oil) from other companies in the port business ecosystem. Third, companies can benefit from symbiosis where companies not only exchange (by)products but also invest in dedicated infrastructure/facilities/processes to increase efficiency. The PDC may play a key role in creating these benefits. An overview of promising segments for CE activities in ports is given in Table 2.

Table 2. Circular activities and location benefits of ports.

| Commodity/value network | Rough estimate of global waste generation | Trade of waste material | Benefit of locating recycling/ processing activities in a port |

| Steel | ˜ 500 million tons | More than 100 million tons (e.g. France and Germany are large exporters, Italy and Spain large importers). | Low inbound and outbound logistics costs for steel and scrap. |

| Plastics | ˜ 400 million tons | Less than 10 million tons of global plastics trade following China’s import ban). | Low inbound and outbound logistics costs for plastics.

Plastics can be converted into fuel; which can serve the fuel demand in ports. |

| E-waste | > 60 million tons | Around 5 million tons of global trade, a substantial part of that is illegal trade. | Low inbound and outbound logistics costs for waste and recycled material. |

| Car tyres | ˜ 10 million tons | Limited | Low inbound and outbound logistics costs for tyres and recycled material. |

| Building materials | ˜ 2 billion tons global waste production. Important waste types include wood, cement, and metal scrap). | Very limited | Low inbound and outbound logistics costs for construction waste and recycled material. |

| Food waste | ˜ 900 million tons | Very limited | Low inbound and outbound logistics costs for food waste and recycled material. |

| Oils and fats | ˜ 40 million tons | Relatively large | Low inbound logistics costs for food waste, an important end-product is transport fuel; which can serve the fuel demand in ports. |

| Batteries | ˜ 8 million tons | Limited | Low inbound and outbound logistics costs for batteries; the market for recycled materials in port. |

| Ships and conventional offshore installations, offshore wind components | N.A. | Ships to be scrapped are traded globally, offshore (wind) generally is not. | Low inbound and outbound logistics costs; the market for recycled materials in port. |

| Agricultural residues | ˜ 3000 million tons | Very limited, some trade of processed residues (e.g. wood pellets). | Low inbound and outbound logistics costs; the market for recycled materials (including fuel and gas) in port. |

There is a growing consensus that most waste materials are best reused and recycled close to the source, for

- economic reasons (often the value of the waste is too low to justify the high cost of long-distance transport);

- sustainability reasons (long-distance transport makes value chains less sustainable);

- geo-political reasons (exporting EOL products can create dependency, for instance in the case of batteries);

- ethical reasons (sending plastics, end-of-life ships, batteries, and other e-waste to developing countries generally leads to environmental hazards and problematic labour practices).

Thus, especially ports in advanced economies, with large volumes of EOL products (such as Europe and North America) are well-positioned to attract circular activities.

Impact of the circular transition on the PDC’s business models

PDCs generally have two main sources of revenue: port dues and land rent. On a global scale, the transition to clean energy and a circular economy is likely to go hand in hand with lower cargo volumes. For individual ports, attracting circular economy activities does not affect traffic volumes, but in all likelihood, such activities generate less (maritime) cargo flows than comparable activities that process raw materials (think of the oil refineries, coal-fired power plants, aluminum plants, fertilizer plants and the like, which generate very significant cargo volumes). As a very rough indicator, such large-scale processing facilities can generate up to 100,000 tons of maritime throughput per hectare. The volumes associated with circular processing activities depend on the spatial scale of circular value chains, as discussed above. While there are large differences (scrap is a more global circular value chain, food residues a much more local one), in general, circular economy material flows are much more local. In the case of Amsterdam, the volume generated by circular activities is a factor five lower than that of linear activities. This would correspond to a maritime throughput of around 20,000 tons per hectare as an indicative figure for circular activities.

The consequence of this difference is, that for PDCs the revenues from port dues are substantially lower. Thus, it makes strategic sense for PDCs to increase the share of land/concession fees in the total revenues. Such a shift is already underway in several ports. A larger share of land/concession fees makes PDCs much more resilient to the changes in cargo volumes that may be on the horizon.

PDC activities to attract circular activities – 4 cases

Groningen Seaports’ focus on the circular industry

Groningen Seaport (GSP) is developing an industrial and energy complex at two ports in the Dutch province of Groningen. The development of a circular ecosystem is already quite advanced, and GSP is developing a large area of new land (around 400 hectares) to further expand this circular ecosystem and attract other zero-carbon activities. Groningen Seaports’ circular ecosystem includes the large existing industrial base, which generates significant waste flows, as well as many start-ups and scale-ups focused on circularity (in some cases linked to the research centers in the region and active in circularity). The circular ecosystem provides feedstock and technology, as well as markets for circular products, especially in four of the segments described in Table 2.

In the case of plastics, the feedstock is provided by the existing industrial base (e.g. packaging materials) and the plant to process household waste and generate energy by incinerating some of it . The market for products made from recycled plastics can be found in local chemical companies that can use, for instance, polypropylene and polyethylene from recycled plastics and fishing nets as a feedstock.

In the e-waste segment, the feedstock is mainly available due to large investments in the data center industry. In addition, the companies operating the data centers (such as Google) have set ambitious circular targets. The feedstock is also available in decommissioned wind blades , as Groningen’s ports are used to build offshore wind parks and their service (e.g. maintenance). Decommissioning programs are likely to start as soon as the wind turbines reach the EOL stage.

Related re-source

Recycling wind turbine blades at Groningen’s Eemshaven

Finally, in the building materials segment, companies produce concrete containing at least 30% recycled concrete granulate and use estuarine silt as a building material resource.

GSP’s approach to developing a large area of new land (around 400 hectares) to further expand this circular ecosystem has four interesting characteristics. First, GSP is very much taking an ecosystem approach, seeking to attract circular activities in the segments discussed above, and also to attract circular activities that help existing companies in the port industrial area to transition away from linear and often fossil-based value chains. Partly with this in mind, GSP is exploring opportunities to attract large-scale facilities to recover rare earth metals from EOL products.

Secondly, GSP has moved away from a land sale business model, towards a land lease business model. An important reason for this choice is that GSP is better positioned as a permanent developer of the port industrial area with such a lease model in place, as in this model, as it has more tools to influence land use.

Thirdly, although GSP has a very large area available for development (400 hectares, making GSP the port with the largest amount of available land in the Netherlands) GSP aims for high land utilization, as it foresees an increasing scarcity of land in port industrial complexes. GSP also focuses on attracting circular activities for which port infrastructure is important/critical.

Fourthly, the GSP (together with other public stakeholders, regional and local governments, and knowledge institutes) has developed a joint approach (Chemport Europe) to attract investments in sustainable and circular chemicals. Support for potential investors also includes support in applying for available public funding sources. Funding opportunities are attractive in Groningen compared to other locations in the Netherlands.

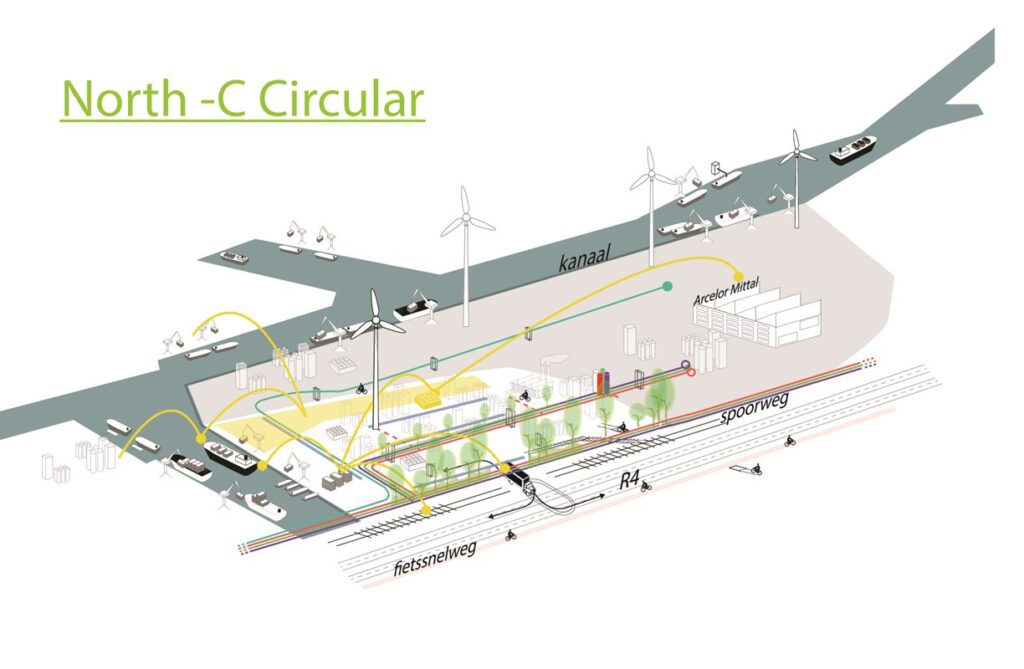

North Sea Port: attracting circular activities and greening the existing steel plant

North Sea Port (NSP) and ArcelorMittal Belgium have jointly launched the North-C-Circular initiative for the development of a port area, specifically designated for circular business activities. This 150 hectare area, located next to the ArcelorMittal site, will be redeveloped (construction of quay walls, basic infrastructure, utilities, and rail access) for circular activities, including activities that are essential for the greening of the ArcelorMittal plant in Ghent. North-C Circular will provide land for Arcelor’s investments in green steel production by replacing fossil coal in the steel mill with biocoal, which is produced from wood waste (through ‘torrefaction’), and capturing the carbon monoxide to convert it into ethanol (which can be used as a transport fuel or building block for producing chemicals). The new area will also be the site of a terminal to liquefy CO2 and load it onto ships. This Carbon Capture, Utilisation and Storage (CCUS) initiative, which will capture emissions from industrial users including ArcelorMittal, is essential for CO2-intensive industries to achieve net-zero emissions. On top of these projects already in an advanced planning stage, NSP aims to attract at least 10 still unknown circular activities to the North-C-Circular site.

Related re-source

ArcelorMittal Belgium and North Sea Port are to build the North-C Circular industrial site

Circular activities in Seville’s Port Business Ecosystem

The Port of Seville (Puerto de Sevilla) is an estuary port in the south of Spain. Located inland, its access to the sea is limited by depth and, partly for this reason, it specializes in logistics and industrial activities. It hosts various circular activities and is gradually developing a circular ecosystem. Recently, two companies have announced plans to invest in new facilities in Seville’s Port. Firstly, Biomet intends to invest in a biogas plant, specifically for the production of biomethane, on a site of around 3.5 hectares. The company will use residues such as refining pastes, degraded oils, tars from distillation processes, and sewage sludge. In addition to biomethane, the plant will also produce energy.

A second company, Edefos, is planning a similar circular economy investment in a new organic waste biogas plant. They will occupy a 1.5-hectare site and invest in a renewable gas production plant that will use agro-industrial organic waste and biowaste to produce biofertilizer and biogas, which will in turn be converted into biomethane. The plant will collect the residues from the surrounding agricultural and industrial sectors, such as companies producing citrus juice and canned fruit. Efedos intends to feed the biomethane into the natural gas pipeline network.

These two recent investments complement previous circular investments amongst others in wastewater treatment, and tiles production from waste residues. The emergence of a circular ecosystem is beginning to generate synergies for the companies located in Seville’s port area. For example, Efedos and Biomet will jointly invest in pipeline infrastructure, resulting in significant cost savings. The Port of Seville expects further interest in circular activities and has initiated a project to expand the available land area by up to 76 hectares.

Amsterdam’s evolving circular economy business ecosystem

The Amsterdam port complex comprises more than 1,400 companies in a port area of more than 4,500 hectares. The PDC of Amsterdam is called ‘Port of Amsterdam’ (PoA), a public corporation (fully owned by the municipality of Amsterdam). The municipality of Amsterdam has an ambitious strategy for circularity: it aims to become fully circular by 2050 and sees PoA as one of the key players in driving circularity.

PoA has developed a strong ecosystem of circular economy companies specializing in the recycling of plastics and rubber, demolition waste, food and agricultural residues, and metals. Before 2010, 10 circular companies were already active, mostly in scrap recycling. During 2010-2019, 11 new companies were located in Amsterdam’s port area. From 2020 onwards, the established circular economy companies have evolved, in some cases through takeovers, the establishment of subsidiaries, and expansion projects. The current list of circular companies includes 28 entries, which have grown ‘organically’ from the activities in 2019. For example, Biodiesel Amsterdam was acquired and integrated into Argent Energy. This made it possible to expand the facilities. PoA and Argent Energies have jointly invested in land reclamation (around one hectare) and larger quays, enabling investments in more storage capacity and more maritime cargo flows. After 2020, no major new circular economy investments have taken place in the Amsterdam port complex. There are two main reasons for this.

Related re-source

Prodock – Amsterdam

Firstly, after PoA’s initial success in attracting circular activities, PoA also became more aware of the fact that land in the port area is scarce and will remain scarce, even if and when land currently occupied by ‘fossil’ activities will be returned to PoA. As a result, PoA introduced the use of port infrastructure by circular activities as a relevant selection criterion for interested circular companies. Companies can only lease land with direct water access if the vast majority of their commodity flows arrives/departs by ship (inland or maritime). In addition, so-called ‘second line’ land plots (in the port area but without direct access to quays/water), can only be leased if around half of all material flows arrive or depart by ship. Note that these requirements are relative: PoA does not focus on attracting large (absolute) shipping volumes per se, but on circular activities that use maritime connections, regardless of whether their material flows are large or small. A significant number of companies that are/were interested in locating in the Amsterdam circular ecosystem do/did not meet these requirements. For instance, activities that process circular intermediates (e.g. plastic pellets) that arrive by road in containers , with very small non-existent shipping volumes for Amsterdam, do not meet the criteria and PoA would therefore decline to offer land to such activities. Instead, PoA would direct such interested companies to other ports or inland locations.

Secondly, PoA has been operating in an almost perfect storm since the end of 2023, which has so far prevented final investment decisions for new large-scale circular activities with significant maritime flows. This is partly explained by Russia’s invasion of Ukraine and the resulting geopolitical turmoil and price pressures on oil, gas, and plastics. In addition, on the domestic front, the relevant government bodies in the Netherlands are struggling to provide a stable and predictable operating environment for potential new investors. Problems with the electricity grid and nitrogen deposition complicate the permitting process and create delays and uncertainties that worry investors.

As a result of these experiences, PoA now is more aware that the circular transition is a long-term game. PoA continues to strive to attract new investments in circular activities and to improve the circularity the commodities and value chains that pass through the Amsterdam port complex. The existing circular ecosystem has evolved and the circular companies actively creating new synergies, for instance through the collective purchase of energy. PoA remains committed to the long-term circular ambitions: ‘the circular transition is a marathon, not a sprint’.

Four concluding reflections

Based on the analysis of the PDCs’ investments, the conversations with the PDCs described as cases, and previous work on the circular transition in ports I would like to share four reflections, that may be useful in further developing circular activities in ports.

Synergies in circular ecosystems

As a first reflection, it is clear from the cases and the conceptual part that a circular activity does not start in splendid isolation. On the contrary, circular activities are attracted by the strength of a port complex, especially in terms of feedstock and markets. As the Amsterdam case clearly shows, once various circular activities have been attracted, this base creates synergies for future circular activities. This can lead to a circular ecosystem in which all businesses thrive. Some elements of this circular ecosystem can be considered as ‘must-haves, with a high strategic value. For instance, waste sorting facilities may not seem very advanced, but such facilities are key components of circular ecosystems. Conceptually, there are various stages in the development of a circular business ecosystem. From start-up, often driven by the availability of specific feedstocks and markets, to scale-up (where a PDC approach focused on synergies becomes important) to the circular hotspot stage. In such hotspots, where synergies and scale continue to increase, a selective growth approach is prompted to maximize the use of available land, and securing port land is only used for circular activities that benefit from and use of the port infrastructure.

More land, not necessarily more quay walls

Secondly, the cases clearly show the value of land in the port area, even if the activities on this land do not directly generate (large) maritime flows. The circularity transition goes hand in hand with less global flows, certainly of raw materials. Port business ecosystems are thus transforming, and in that transformation, they need more land, not necessarily more quay walls. This means the nature of port development projects needs to change, less focused on ships, berths, terminals, and nautical access, and more focused on meeting the demand for land from zero-carbon industries. When it comes to port development, it often makes sense to take a kind of emergent development approach, where the demand for land for circular activities from one or a few companies is central, but where the PDC takes a make it bigger approach, to creating land availability for as yet unknown circular/zero-carbon activities. North Sea Port has taken this approach in its C-circular project.

Business ecosystem services

Thirdly, the PDC can create value for companies in the port by providing additional services. Examples of such services include pipelines for CO2/hydrogen transport, lectric power cables, and energy management systems. Through these services, the PDC improves the overall efficiency and productivity of the port complex. It is advisable to adopt an ecosystem approach from the start so that companies buy into an approach aimed at collective efficiency from the start. This may involve sharing terminal infrastructure, pipelines, or even waste collection networks. Experience shows that it is an uphill battle to increase such synergies once lease contracts have been signed and investments made. In addition, it makes sense to invest in a circular community, for instance, by involving new circular companies in innovation networks and projects (think of initiatives for collective energy purchasing and exchange). Finally, it may even make sense to oblige tenants located in the port to participate in a collective circularity reporting initiative carried out by an independent trusted third party to ensure that all companies in the circular ecosystem can share verified data about their processes.

Circular economy activities may expand boundaries

As a final reflection, circular activities may initially clash with certain ‘boundaries’ within the PDC. Circular activities may start small and do not generate substantial maritime flows. It may therefore be argued that locating such activities in a port is not the best use of the scarce port space. This may lead to resistance within the organization or lack of interest and consequentially resources. However, a look at the ports that have launched initiatives to attract circular activities shows how such projects have gradually led to more sustainable and resilient ecosystems. Consequently, circular activities have moved away from the periphery to the centre of port development -to the point where PDCs are giving them a prominent place in their long-term development visions and commercial efforts.

Good luck to all advocates of the circular economy who want to bring it more to the centre of port development. As far as I can see, the wind is at your back.

sources

- Port Authorities (PAs), Port Management Bodies (PMBs), and Port Development Companies (PDCs) are often used interchangeably. In the context of this opinion piece, the use of PDCs is preferred.

- See https://www.eea.europa.eu/en/analysis/indicators/circular-material-use-rate-in-europe#

- I acknowledge that there is no clear way to distinguish ‘circular activities’ from ‘non-circular activities’. In principle, all activities in value chains that are circular could be considered as ‘circular activities’ (including, for instance, the sale of circular fashion). However, from a port perspective, the most useful way to think of circular activities is as activities that collect and process materials at the end of a life cycle for some form of reuse.

- This is not hypothetical: given the relatively small volumes of flows of such intermediates, container transport is often used. These containers can be transported by road from, for example, Rotterdam, the largest container port in the Netherlands, to Amsterdam.