Making insights actionable

Financing as an ultimate lever for circular economy activities

Financing is the ultimate lever for circular economy activities. The public sector will have the greatest capacity to drive the agenda when it is committed to investment. Ultimately, who pays for the circular economy? And when should the public sector get financially involved?

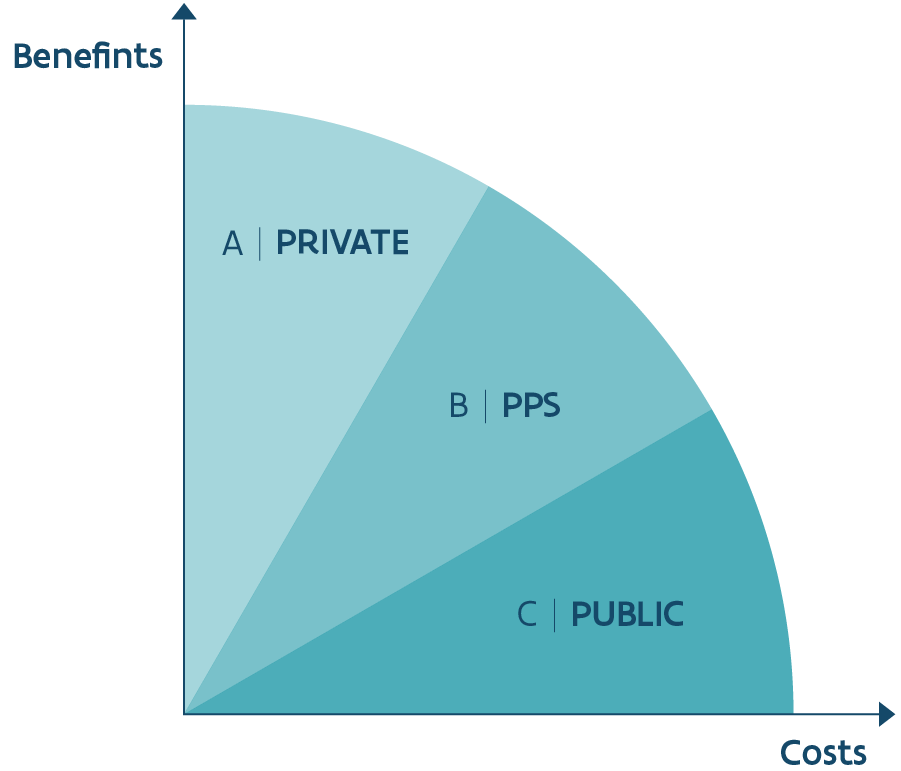

A simple way to visualise who pays is by looking at two axes between benefits and costs (see above). The private market will attribute benefits to capital, while the public sector may attach additional environmental and social values. If the (financial) benefits far outweigh the costs, then it can be assumed that the private sector can take full responsibility and the development will be on their terms.

When public financing is involved, an opportunity will be created to define the terms of the use of the land. Where there are considerable starting or running costs, then a Public-Private Partnership may be most effective to reduce the risk or financial burden for the private sector, yet increase the exploitation efficiency. If an activity has very low financial benefits, but considerable social and environmental benefits, then the public sector may need to cover the full costs. This is particularly the case for polluted land or waste management infrastructure. This insight may include three larger forms of financing: private, public and public-private.

Private investment

Many forms of circular economy activities are best handled by the private sector. The tools for activating finance is an important lever to be used in dialogue between the public and private sector. Private investment may include:

- Capital: this could be through financial reserves, real estate assets or shares.

- Debt: essentially loans, bonds or shares.

- Lease or sales agreements: advancing finance through committing to deliver a good or service in the future.

- Mergers and acquisition: where a business can acquire skills, assets and/or technology through merging with another business. This may be necessary where two similar operators within a port could be grouped to increase capacities and competitiveness.

Examples of how the private sector operates can be inspiring to help incentivise other businesses or operators to reproduce the same concepts elsewhere.

Public investment

As many PMBs are partially or fully publicly owned, it can be useful to consider each as both operating with the public interest.

Port Management Bodies (PMBs)

Many PMBs are privately structured, public organisations. They typically have two sources of revenue which can be used for financing projects. Firstly, port dues for occupation. And secondly the concession fees, the amount a business or operator pays to access the site. PMBs have a limited range of financial tools, but those available can be used to encourage operators to take risks or drive innovation (de Langen et al 2020). These include: 1) paying cash sourced from revenues, 2) start-up discounts, 3) delaying payment or 4) offering subordinated loans. PMBs can also define specific conditions based on the concession agreement (see Insight 1) in terms of the type of activity occurring on the site.

Public authorities

The public sector may have a wider range of financial levers than PMBs. This includes regulation (policed through fines), grants and loans. In Europe, various levels of government have different competencies and access to financing which means that public co-financing (public co-investment from local to European levels) can occur.

Public – private partnerships

The Public-Private Partnership (PPPs) is an agreed structure where the stability and resources of the public sector enable the private sector to develop, build or operate a project. PPPs are a common way to balance public policy or objectives with private efficiency and risk-taking. There are numerous forms of PPPs as described in “Port Economics, Management and Policy”, Chapter 4.3. This can include a range of constructions such as ‘build-rehabilitate-operate-transfer’, ‘build-own-operate-transfer’, ‘build-lease-own’ and so on. A good understanding of the range of options can help explore faire partnerships where both party can find a constructive outcome.